Texas has the oldest and most successful deregulated electricity marketplace in the U.S.

A decade ago, deregulation was rolled out by the Electric Reliability Council of Texas (ERCOT) in the wake of California’s $45 billion partial deregulation fiasco.

By 2008, 80 percent of Texas registered voters favored a competitive electricity market, and, by 2010, 55 percent of residential customers had selected a competitive retail electricity provider or product. In 2011, for the fifth consecutive year, an independent authority named the Texas market the best in the country.

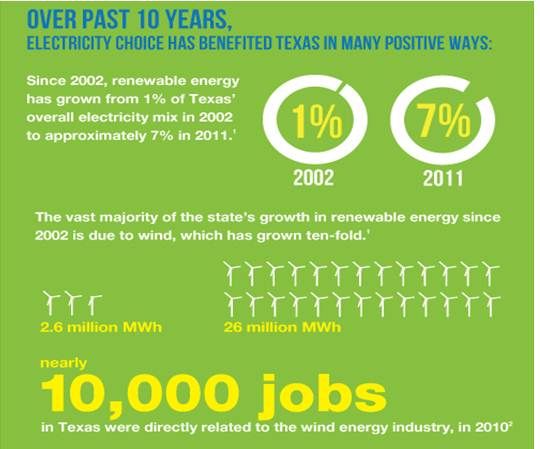

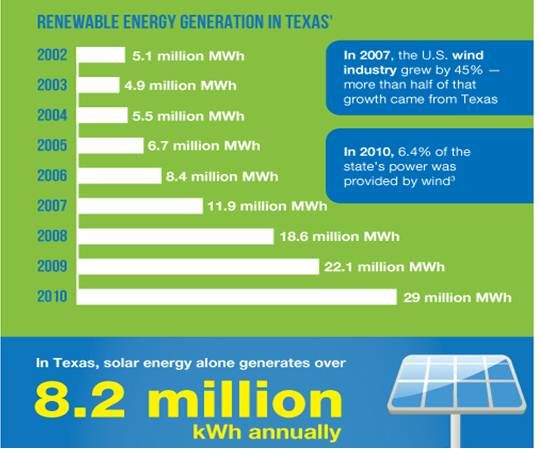

More importantly, renewable energy in Texas grew from one percent in 2002 to over 8.5 percent in 2011. Wind grew ten times over, from 2.6 million megawatt-hours to 26 million megawatt-hours, and, with over 10,000 megawatts of installed capacity, Texas led all states (and would be fifth in the world if it secedes). It created nearly 10,000 direct wind industry jobs in the process.

“A disproportionate amount of the wind that has been built in the U.S. has been built in those places that have market structures,” American Wind Energy Association (AWEA) Transmission Policy Manager Michael Goggin explained. “Markets provide a uniform, fair-price signal for all of the energy resources. Markets also tend to come with grid operating procedures that make the grid more efficient for all users and reduce the discrimination that wind plants are sometimes faced with.”

A good market design like ERCOT’s, Goggin said, includes “fast sub-hourly generator dispatch, fast transmission scheduling, wind energy forecasting, and ancillary services markets to efficiently provide flexibility. And markets tend to be large balancing areas, which are a lot more efficient for accommodating variability.”

The benefits, Goggin added, “are really quite staggering.” Grid operator studies put consumer savings and other returns from electricity markets “in the hundreds of millions of dollars per year,” he said.

ERCOT’s initial rules and standards, according to ERCOT CEO Trip Doggett, were the product of “thousands of hours of meetings and mark-up sessions” involving market participants and consumer representatives.

“On January 1, 2002, ERCOT launched the competitive retail electric market -- on time and on budget -- allowing individuals and corporations in most cities (approximately 74 percent of the ERCOT load) to choose power suppliers,” recounted Doggett. In the intervening 10 years, ERCOT has “evolved from a small organization responsible for ensuring a reliable electric grid to the entity that facilitates a market capable of responding to the opportunities of 21st-century innovations” and economic pressures.

ERCOT’s most recent “comprehensive market redesign,” Doggett noted, enabled “locational marginal pricing for generation at more than 8,000 nodes” and added “a day-ahead energy and ancillary services co-optimized market.” The redesign instituted more “efficiency and incentives to invest in the right places.”

Federal Energy Regulatory Commission Chair Jon Wellinghoff, Doggett pointed out, called ERCOT’s $34-billion market and 335,000-gigawatt-hour marketplace “the most robust retail competition anywhere in the country.”

The average electricity rate for ERCOT’s 1,150 generators, movers, buyers, sellers and consumers, according to Doggett, is $0.10 per kilowatt-hour.

“ERCOT has led the field in wind development,” noted Doggett, adding, “We are learning how to successfully manage increased wind integration. We developed the first-of-its-kind wind-ramp forecasting tool to help operators prepare for large and sudden changes in wind production. Our current wind record is 7,400 megawatts, which occurred at 3:06 pm on Oct. 7, 2011, accounting for 15.2 percent of the load at the time. In 2011, 8.5 percent of our energy came from wind generation.”

Green Mountain Energy Company (GMEC) was one of the first U.S. electricity retailers, one of the first into the ERCOT marketplace and the first to sell renewable energy to Texas residential and commercial customers.

Retail competition has allowed Texans to choose their electricity provider and their preferred source of electricity, explained GMEC’s Helen Brauner. “In Dallas, there may be 30 different rates and all different flavors now.” Some, she said, just sell system power. “We sell green power.”

GMEC was created by Vermont utility Green Mountain Power “to change the way power is made through consumer choice.” Escaping their first effort in California’s deregulation disaster, GMEC turned to ERCOT.

“We could see it was promoting competition,” Brauner said. GMEC moved its headquarters from Vermont to Texas. “What we thought would happen has happened,” Brauner said. “A lot more people understand now, and I think we had a hand in it, that electricity and pollution are connected.”

“Texas has derived immense value from diversifying its energy portfolio,” AWEA’s Goggin said. “Just five years ago it was much more dependent on natural gas [... and] was a lot more susceptible to the natural gas price volatility that does major harm to consumers.”

More significantly, Goggin said, “Twice in 2011, wind power was instrumental in keeping the lights on in the state.” In February, because of unusually cold conditions, “8,000 megawatts of conventional fossil plants went down and wind was producing above expectations, at about 3,500 megawatts.” And in August, Goggin added, “the state also had power shortages when it was unusually hot and they had some conventional plants that weren’t producing as expected but wind was there producing well above expectations.”